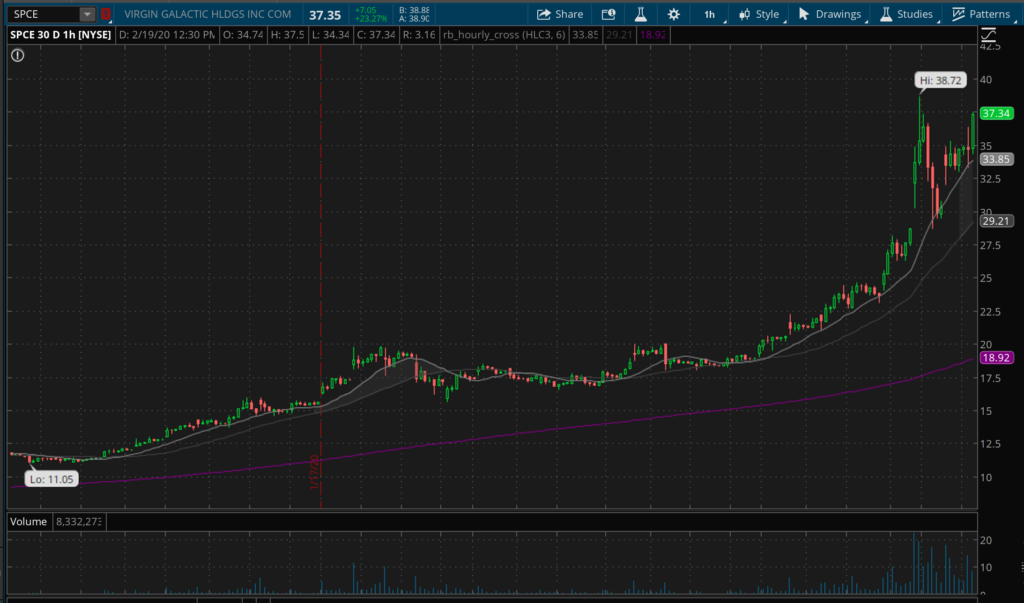

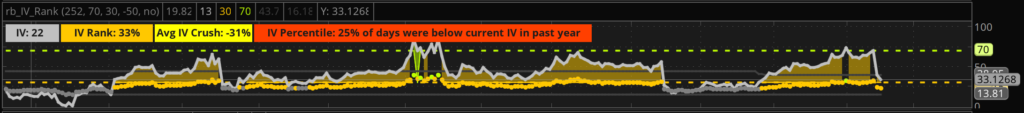

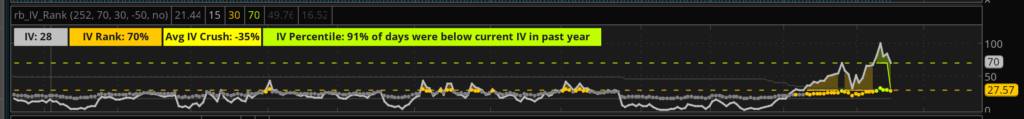

This past week we witnessed the most significant market selloff since 2008. The major indexes are all down more than 10% – straight down more than 10%. Vol was “bid” all week and we just barely got into oversold territory by the end of the week. The charts below show just how dramatic the move was, and the extreme vol spike that followed.

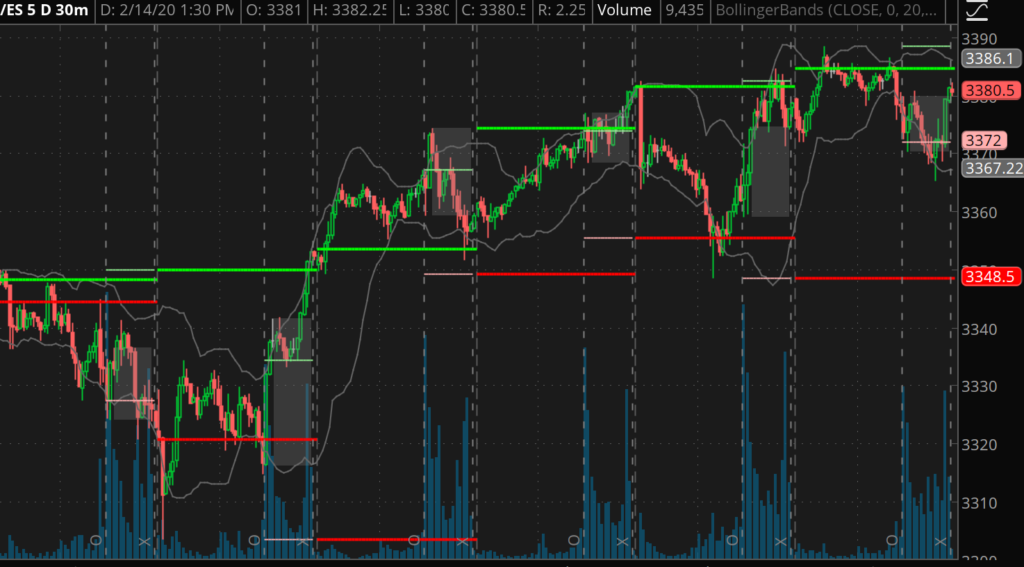

It was a weird week. The selling was fast, and consistent and unexpectedly directional. By that, I mean that typically when we see these types of events they whip around a bit, this was just a rapid orderly down move. Honestly, I’m still a bit shocked. The hourly chart below shows how it just drove down, basically straight down. The overnight session had massive moves this week as well, with some very choppy tape.

For me, it was really a tale of two tapes. I’ve made no secret of my expectation that the markets are coming down. I’ve been short and loading up on shorts and Monday was a great day for me. However, I exited my positions very early in the week and started to load up on short vol and long delta.

I really started to load up on Wednesday when the market appeared (for a brief moment) that it was poised to bounce a bit. This was a doubling down on short vol, and then getting long a tremendous amount of delta via /ES futures. You can see what appears to be a nice bottoming over night with some a nice push higher and a push higher on volume at the open Wednesday. I read this as the market being poised for a brief recovery…

Those two positions, short vol and long delta worked against me in a material way this week and by the end of the week I had blown through all of the weekend profits and realized some pretty sizable losses due to the amount of long static delta (ie: futures) I was holding. Looking at the chart below, you can see the brief recovery on Wednesday, and then the intensity of selling that followed the close.

Note: None of the losses I incurred this week are insurmountable or something that I am not prepared to incur. You must always manage your risk and relative position size. My losses relative to my portfolio risk profile are less than the market movement, however my expectation was to out perform dramatically given the action of the market this week.

I’m pretty disappointed in my performance this week; but am happy that I hedged my longer term investment accounts into a very conservative position before this drop began. Overall, it’s a win for the good kids (as they say on tastytrade) but it wasn’t a win for my speculative accounts – bummer.

I have a handful of positions that simply got crushed this week. Most of my put spreads have been breached on both strikes and I’ve been defensively selling call spreads to offset the exposure or rolling out in duration where possible to allow the market to take a breather and allow theta to work its magic.

My short term perspective on this market remains bearish. I’m still shocked that we haven’t seen a fierce up day given the massive downside movement; however I’m not interested in trying to speculate on that during this type of price action any longer.

It’s tough to be a trader when you have a full time job, and that really hurt me this week as I have to have a set it and forget it attitude for a large portion of the trading day.

Intermediate term, I expect we’ll be in a depressed earning cycle for the next couple of quarters (even if the COVID-19 outbreak doesn’t become a true pandemic like Spanish Flu or something similar). The panic and physical changes that we are making in relation to that panic: shutting down factories, stopping travel etc… are going to put a real damper on demand and supply. For those of you with an economics background, you understand how bad of a combo that is.

There may be real structural losses that will take years to recover depending on the severity of the demand/supply shocks.

The human toll of this virus is tragic, and my heart goes out to all of those affected.

In terms of a market outlook, I wouldn’t be surprised to see an additional grind downwards into a technical bear market. Given that I have an economics degree I’ll hedge that off and add the flip side that I also wouldn’t be surprised to see the market continue rally from this point and recoup a large degree of the losses. 🙂

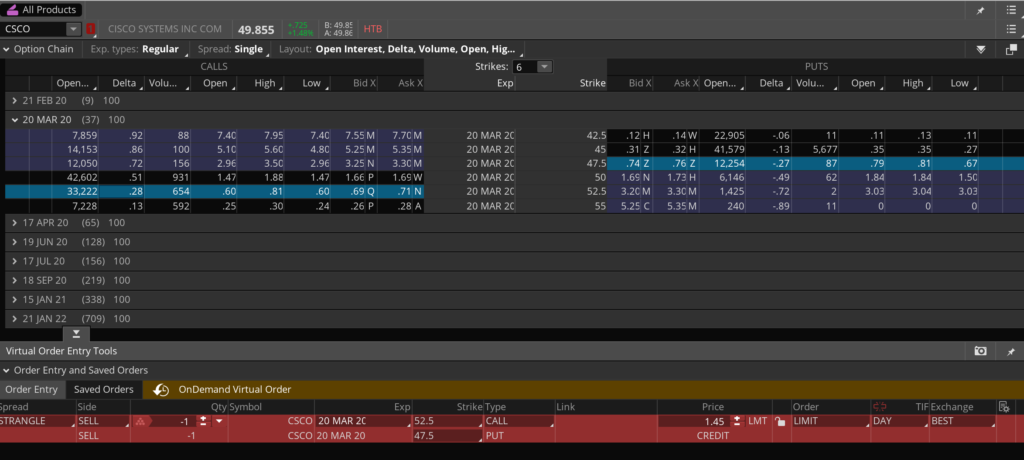

As for current positions, here is what I’m dealing with right now:

AAL – Short 2 Different Put Spreads March 6th 18/17 and March 19/18

I mean, it’s certainly possible that American Airlines can go lower; but it has basically been destroyed with the recent sell off. I will very likely keep selling these types of positions on travel related stocks with short term duration for a while.

This trade has moved against me – because I put it on on Wednesday…. I could have sold it for 2x what I did then. Oh well 🙂

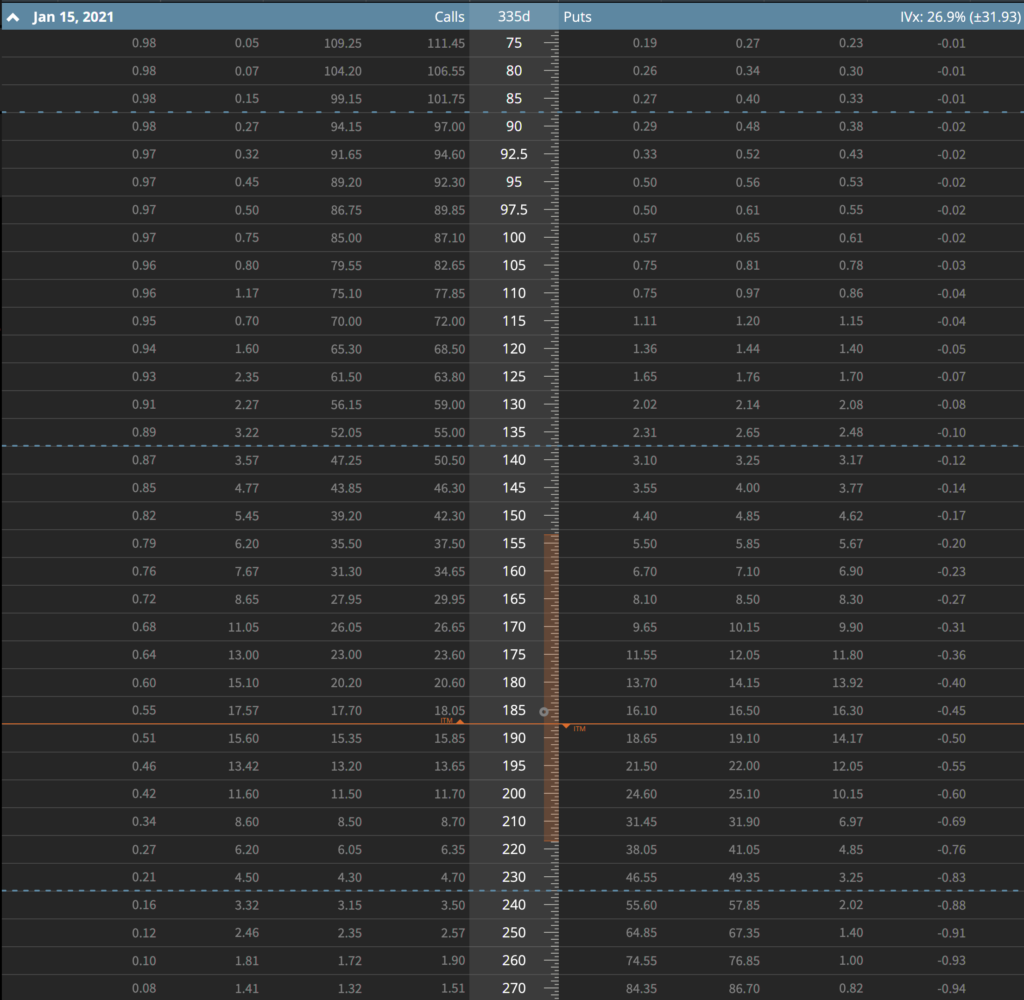

AAPL – Short March 310/305 Put Spread and April 290/285 Put Spread

Apple completely fell out of bed this week. The hourly chart shows clearly how bad this performed during the sell off. I’m encouraged by the tape on Friday, and am really looking to see it move up over the next couple of weeks. The April position is one that I rolled out for a debit on Friday to get some more time. I’m hoping to roll the March position next week on a strong bounce from Apple – otherwise I’ll need to play some different defense.

This week I also sold a 305/310 call spread that expired Friday. Depending on the market action over the next week or so, I’ll continue to sell those shorter term spreads to capture some credits against these breached puts. On these defined risk type positions, I use that offsetting shorter duration spread as a tool to do something similar to going inverted on a strangle. It’s definitely not the same as inversion, and does create some different risks that need to be managed.

ADBE – Short March 365/360 Put Spread

I’ll look to try and roll this out also if the market starts to come back up soon. I was able to sell a call spread this week similar to what I did with Apple to soften the blow on this one. I got about 1/3 the width of the strikes on the initial sale and have increased my total credit to 1/2 of the strikes so far. I’ll keep whittling down the cost basis to hopefully get this one down to a minimal loss if the market doesn’t rally over the next couple of weeks.

AMBA – Long Calls; Various

Ambarella has earnings coming up and I’m hoping for a nice solid gain here. This is a lotto ticket type of play. Right now it’s looking good.

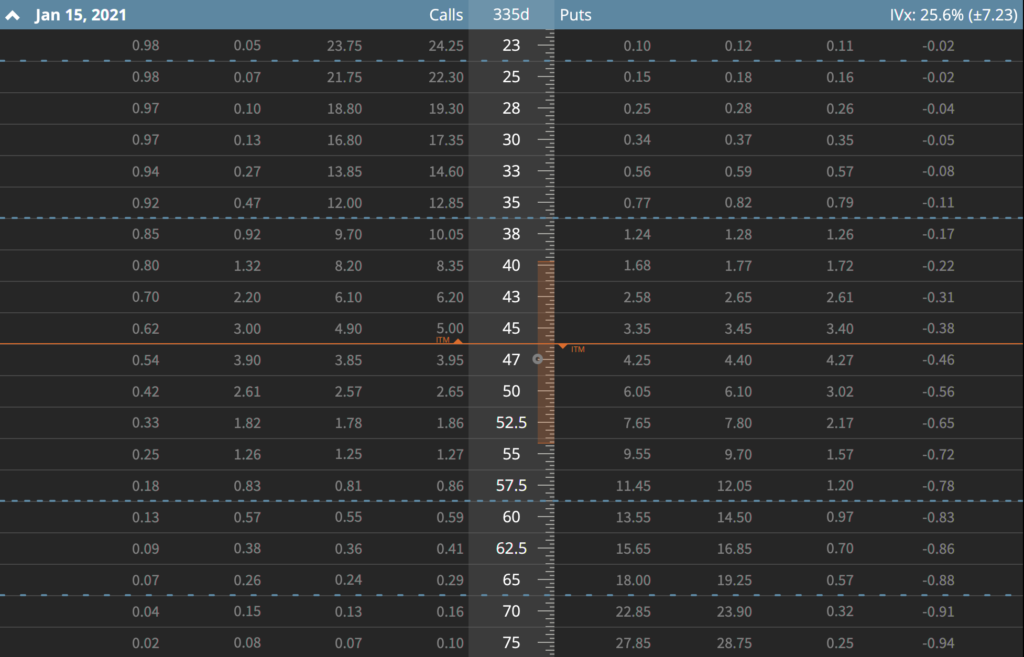

AMZN – Short April 1930/1920 Put Spread

So Amazon just blew the doors off of their earnings and shot up like a rocket ship – then this week started 🙂

This spread started off as the March position from last week, I rolled it out and wider into April. I’m expecting that Amazon will benefit from any COVID-19 risks that are out there as more people will just want to order online and get stuff delivered. I’m basically in this position for about a $5 credit at this point, so I’ll work to spread off the risk once I see market action in Amazon next week.

I’d love to put some calls on above this, but will need some strong upside movement to make that a reality.

CCL – Short March 29/27.5 Put Spread

It’s a cruise line. The stock has been murdered – so much so that it started to recover on Thursday this week 🙂 I’ll keep doing these until I can’t.

CMG – Short March 950/960 Call Spread

This one is kinda of frustrating to me. CMG has fallen to 773 with the sell off. This spread is so far out of the money at this point that I can’t even buy it back! I’ve tried a bunch of different strategies to pull it in to free up some capital but nothing seems to be working. It’s not a huge position, but it’s holding some cash that I’d prefer to release.

I’ll likely go ahead and sell some put spreads underneath it this coming week given that it appears for now that CMG has found some footing.

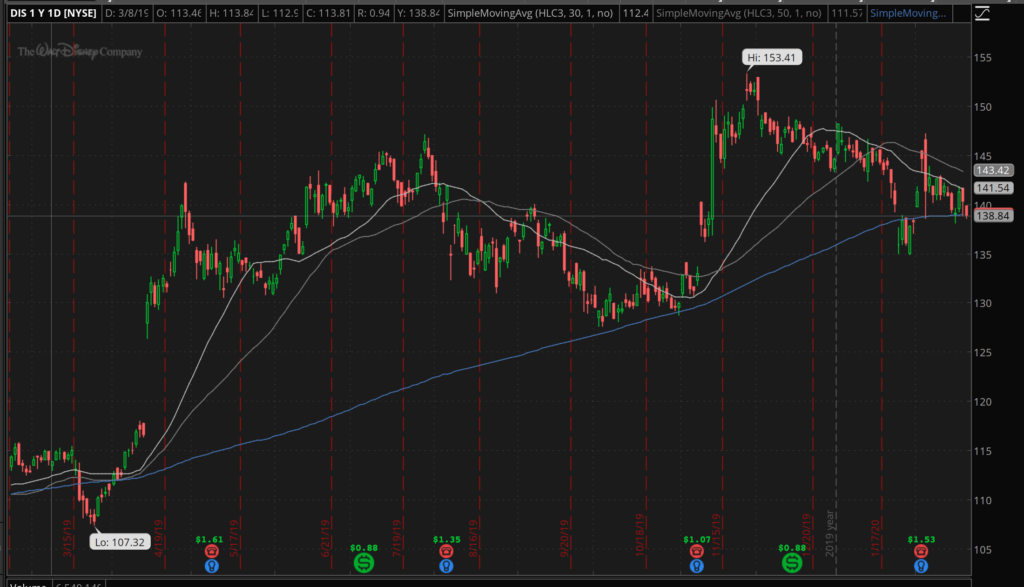

DIS – Short March 6 131/133 Call Spread, March 135/130 Put Spread

This one took a double whammy. With the market drop and abrupt change in leadership, this guy is in trouble. I’m breached and I don’t know if there is any real chance to get this back into manageable ranges.

I’ll keep selling the shorter duration call spreads to try and capture some gains and may end up rolling this out or just closing it down. Disney still seems like a great longer term option, however near term with the parks and everything else, it’s not looking good.

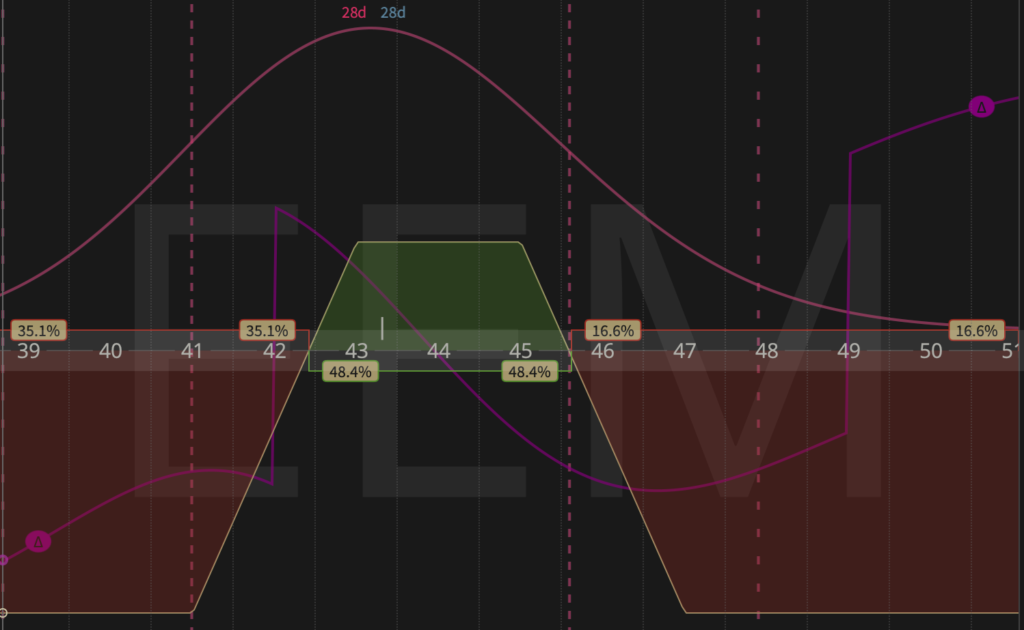

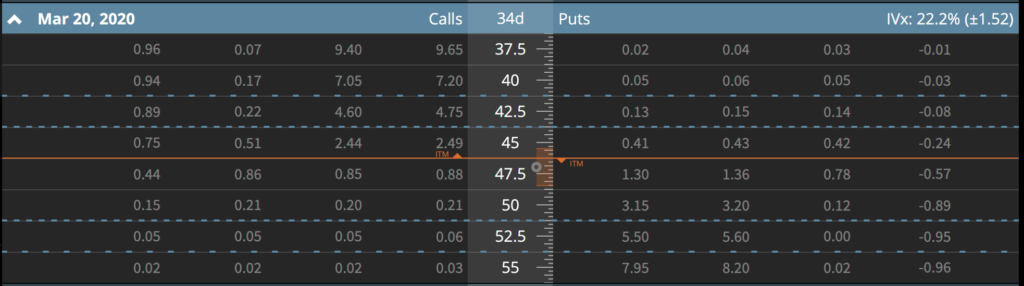

EEM – Short April 40/45 39/33 Iron Condor and 43/41 Put Spread

The Iron Condor on EEM is a new position. Just a normal premium selling type of move. The Put Spread was rolled out for a nickel debit into April. Given the massive moves in the market, I figured it was worth paying a small price to get some more time at approx 21 DTE on this guy. Next week may have been better to move it out, but it felt good to manage positions Friday given the capitulation losses I took 🙂

FDX – Short March 160/165 Call Spread

Woot! This one has come back in and it now profitable. The sell-off this week pulled FedEx right back into its range. I’m going to hold onto this one for a while and watch it decay in value before making a decision on profit target. Right now, I’ve got an order in to buy it back for $0.20 if it gets that cheap.

GSK – Long March 44 Calls

These are likely not going to play out. I’m down about 67% right now on the purchase price. If GSK can rally back next week, then I’ll hold them; otherwise it’ll be time to dump these. They are really going to start getting theta decay quickly now.

INTC – Short March 62.5/60 Put Spread

Another breached spread that I wasn’t able to roll out of. This one is sitting very close to max loss right now so I’ll be using the same strategies to offset the position with Calls where possible.

IWM – Short April 125/120 Put Spread

This is is a 16 delta Put Spread. I only got $0.62 for it however I wanted to start nibbling on new positions that are offensive vs. just defense.

I’ll freely admit that doing a 30 delta is just a little too close for me given the recent tape action and my near term bias. On a sharp rally or two, I’ll likely during this into an Iron Condor with 16 delta calls. If the 16 deltas get to around 170 or so I’ll start selling the other side.

MSFT – Short March 180/175 Put Spread

Microsoft had a strong up move today so maybe it’s possible this guy comes back – however that’s unlikely. I’ll be selling calls against this position for the next few weeks if the tape looks promising.

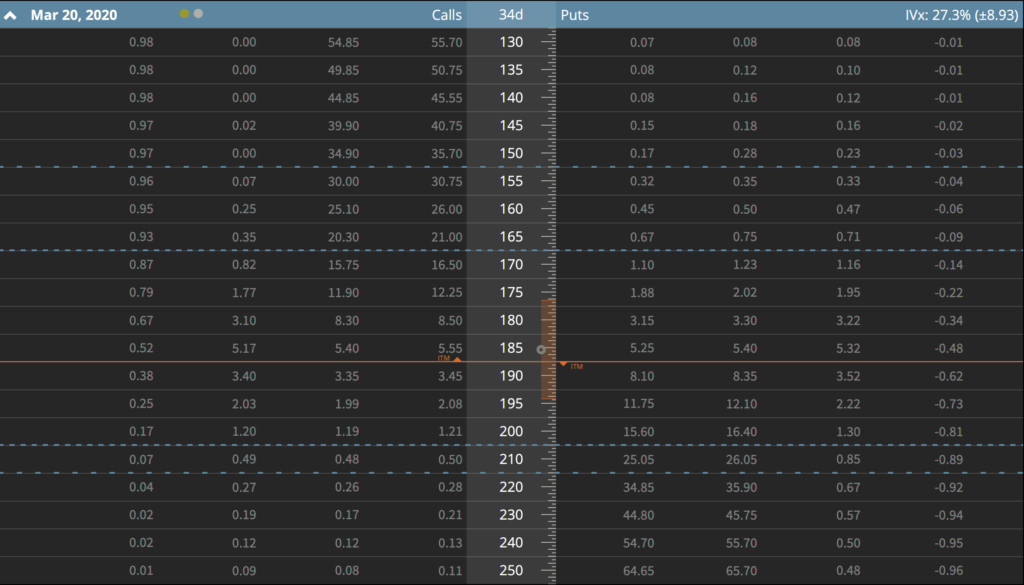

SPX – Nothing, everything expired 100% profitable

This was my best trade for the week! Another 3 for 3 stellar SPX selling test. I laughed on Friday morning when I sold 2725/2720 put spreads for a decent credit with 0 days till expiration. I’ll freely admit that I was worried about selling anything and went insanely low, but good grief – that would have been a 250 point down day in the S&P 500.

I’ll take the profits and smile. This is still a really small trade, but it’s proving nicely reliable and profitable. I’ll keep scaling it up throughout the year where it will hopefully begin to become meaningful in size.

I’m taking the scale yourself approach with it given how risky this stand in front of a train type of trade can be. Meaning that I am only scaling this with the profits it creates.

SPY – Short March 314/312 Put Spread and April 245/240 Put Spread

Welp. I bought back all of my puts on Monday and decided that we had a nice little drop on our hands that could be quickly profited from. So I sold some puts underneath it (why not calls above it, why not calls!!!!!) – ouch.

The March position is totally busted and I’m not sure it’ll come back. I’ll look to roll it if it make sense, or just keep selling things around it. I’m hesitant to sell calls right now until the market gets a bit of a relief rally. Although Tuesday, Wednesday, Thursday and Friday would have all been good times to do that.

TLT – March Iron Condor (Calls Rolled to April) 148/151 142/139

I rolled the calls in this one to April to avoid assignment of the fairly deep in the money calls. It wasn’t cheap, but it was better than taking an almost full loser this early in the game.

Bonds are up, and headed higher. I don’t really think this is going to come back in so I’ll be selling different positions through the month. Worst case, I’ll have cost myself an extra $0.20 for some peace of mind and avoided dividend risk (which was more than $0.20).

UAL – March 60/55 Put Spread

I sold this guy on Thursday. It looked a lot better on Thursday. This may be a problematic spread over the next couple of weeks, so I’ll need to figure it out as the market plays out.

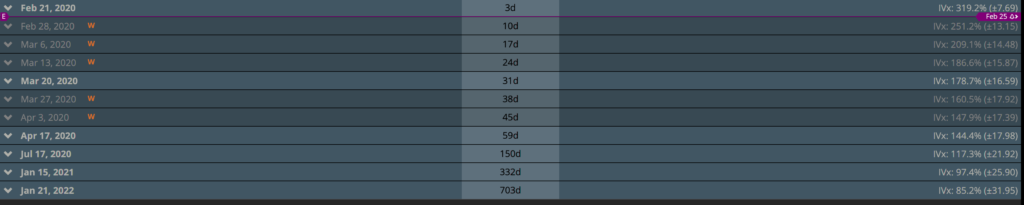

UVXY – Short March 13 15/19 Call Spread and April 17 26/29 Call Spread

Well, this kind of turned into a mess. I started shorting vol early in the week with a 15/17 call spread. That was way too early, so I spread it off again at 17/19 mid-week resulting in the current 15/19. On Friday I put in the 26/29 which is likely the best position 🙂

My 15/19 is going to look really odd as I mange it through the next couple of weeks. Because the original 17’s were basically sold back for a sizable credit on the 2nd spread, the position is now a short debit spread when I look at my P/L. In reality, there is still plenty of credit that I received for doing both of these, however given that the 17’s are flat, the credit is already realized.

I’ll keep doing these if I can over the next couple of weeks as vol comes in. The March 13th spreads may be in trouble if things don’t settle down reasonably soon. I’m find exiting that for a scratch play if needed.

V – Short March 205/200 Put Spread

V had a nice rally today, and hopefully it’ll start to come back a bit. I’ll keep an eye on this and defend as much as I can.

VXX – Short March 17/19 Call Spread

Another early entry. Assuming things settle this should be find. I wish I had done April though 🙂

WYNN – Short 100/97.5 Put Spread

Another new position on a beaten down name. This on is not breached yet and is basically the current 30 delta Put Spread. I’m honestly don’t remember why I decided to make it so tight on the strikes.

YETI – Short March 6th 30/29 Put Spread

Yeti came back above my short strike today which is great. I’d really like to see Yeti hold this into next week so I can get out of this guy for a nice profit.