Tastyworks has quickly become my go to brokerage. If you are an active options trader, it’s my personal opinion that you are missing out if you aren’t using Tastyworks.

Tastyworks is from the same team that started ThinkOrSwim before TD purchased it. These guys know options inside and out and have built some of the absolute best trading platforms for the retail trader over the years.

If you are interested in using Tastyworks here is my referral link. If you choose to sign up, I get a “credit” on their referral program. Unfortunately other than having a really great broker – there isn’t anything special in it for you 🙂

When you first open it up, tastyworks can be a little difficult to figure out. They don’t offer paper trading or anything like that, so the learning curve can be a little awkward out of the gate – however once you get the hang of it you’ll wonder how you ever traded without this type of a setup!

I’ve used ThinkOrSwim for a long time and as soon as Tastyworks charting gets up to the capabilities I have in TOS, it’s very possible I’ll be closing those accounts down and moving everything to Tastyworks.

So, when it comes to a brokerage – let’s talk brass tacks.

Fees: Tastyworks has been a low price leader for a long time. Tom Sosnoff and Scott Sheridan have been at this active options trading thing for a long time and they understand it. In fact, they offer max commissions for larger lot traders which is basically awesome. All of the details are available on the Tastyworks site: https://tastyworks.com/pricing.

Fills: Well, let’s just say I see price improvement consistently. Here is a quick little example on a spread I put in the market for EXPE last week. I was filled for a $0.03 larger credit than my limit. Fills are quick and the commission structure of $0 fees (for the most part) to close is really awesome.

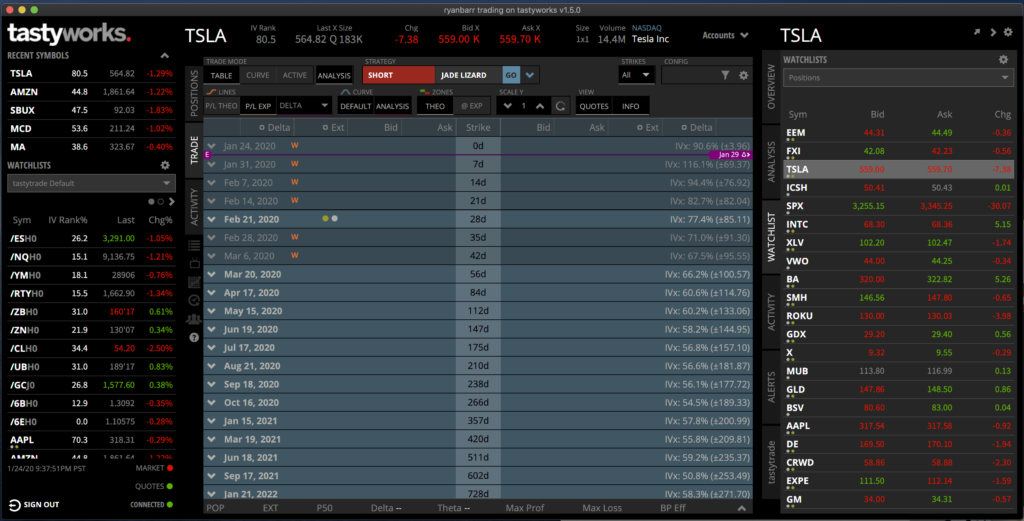

Tech: The platform is really, really good. I’m going to put a couple of screenshots up from my platform. It’s developed for options traders, and it really shines when trading options! It’s kind of awkward for stocks and the active trader setup for futures is only so/so today. I’m confident the team will continue to only improve it!

Tastyworks is really setup to be in 3 “fixed” panes. The pane on the left is your watch lists – it’s always there. The middle “bigger” pane is where the action is, and the right side is where you have lots of options for analysis, activity and all the good stuff.

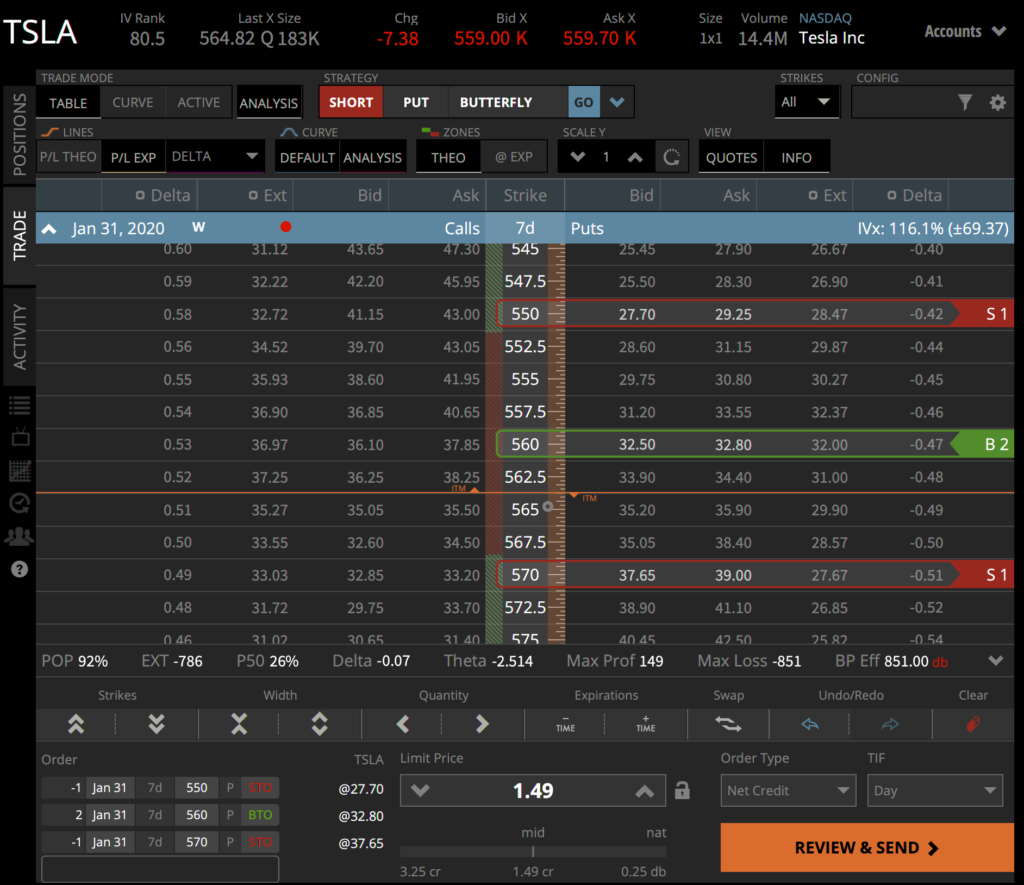

That middle panel is where things get fun! (I’m not actually going to do this trade, it’s an awful example but easy to show why the platform is so cool)

By simply clicking on the Jan 31 2020 weekly option chain, the chain just opens up.

Then you can ether really simply just click on the bid and asks to put up a spread or complex position, or use the little “strategy selector” to put on a trade. The legs can be dragged and dropped and it’s super intuitive.

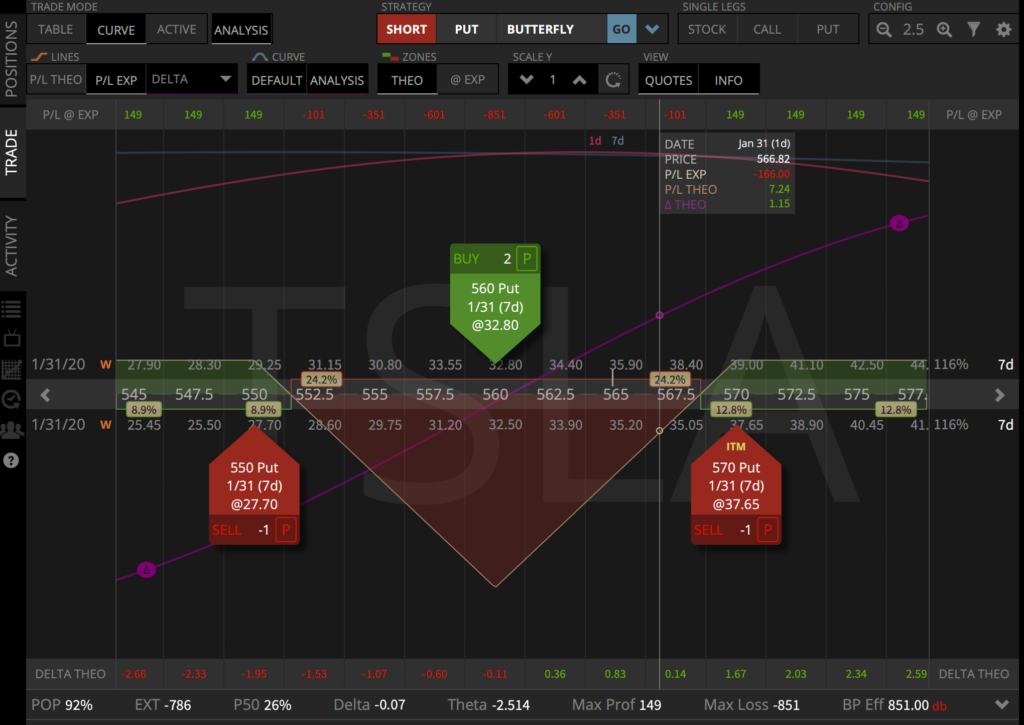

If you want to see what the risk looks like, then just click the “curve” button up top and then you see something like this.

I love this view! (I hate trading from it, but love to look at) This butterfly makes money if TSLA flies off the handle in either direction after earnings. Looking at the chart it’s totally obvious that it makes some money below ~552.5 and above ~567.5, you start to loose a bunch more as you come closer to the long puts at 560. I’ve got a bunch of extra lines turned on to show profit potential and delta positions over time – it’s crazy powerful!

I’ll likely do some more posts on how to trade with Tastyworks over time. Needless to say – I’m a huge fan and can’t recommend it enough. If you don’t have a great brokerage – Sign up with Tastyworks from my link. If you don’t want to use that link – no problem – go to http://www.tastyworks.com and simply check it out!