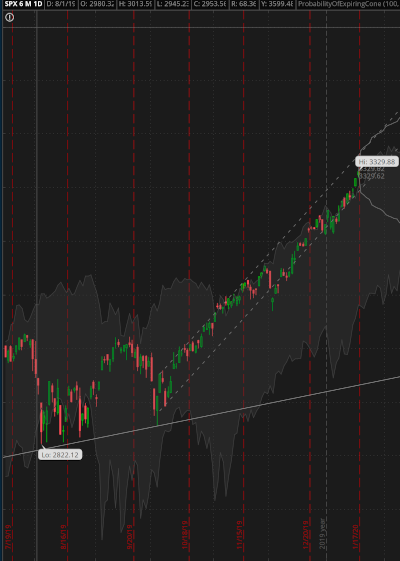

What a crazy week! The market continues to simply melt upwards with very little downward pressure. The S&P 500 found basically zero resistance this week and has found fresh new highs.

The 6 month chart of the SPX to the right shows that it’s stubbornly holding that channel and rocketing higher. I’ve been (and remain) short /ES many times week – these trades have very clearly reminded me of the unrelenting pressure to the upside. (These have been my downfall this week. Costing me roughly 1/3 of the profits I took in on other trades)

Trading action this week is looking more and more like a top to me. I don’t know if it’ll all fizzle out in 2-3 weeks, or 2-3 years give the current macro economic climate (unemployment, interest rates, fed accommodations etc…) however it can’t go on forever.

Speaking of things that can’t go on forever… How about TSLA this week? Wow! It has been on a parabolic move to the upside, a classic short squeeze. This was a great candidate for a very profitable put credit spread, and now I’m short a call spread to pull some more profit out as it settles somewhere lower before earnings.

TSLA wasn’t the only parabolic mover in this FOMO frenzy. I also took some nice profits in BYND this week with a debit call spread and then selling some premium on very short dated options prior to earnings. Both of those turned out nicely!

I was able to clear some positions up this week as well. The TLRY puts from last week came in for a 50% profit, so did the XLE Iron control I put on. I’ll look for chances to reload both of those next week if possible. It was fun to have my watch buzz over and over throughout the day as orders filled for profits – not all weeks are like that :).

When I open a trade, I also ensure that a profit taking GTC order is placed. Given that I can’t sit at my computer screen and trade all day, I use these to ensure that if the market moves while I’m at work (which is most of the trading day) I don’t miss the opportunity to take profits.

I did have a couple of losers (both I tried to play on the bearish side). Over the weekend I thought I saw a couple of nice setup’s in TWTR and MSFT for downside moves. TWTR started the week out nicely moving down, and then simply turn around and I closed out for a loser. MSFT was pretty much just a bad read; going back to look at the charts today I’m not even sure what I saw… Oh well, closed for a loss. MSFT was opened at $0.57 a contract and closed for a loss at $0.46; TWTR was opened at $0.33 and closed for a loss at $0.25.

On trades like MSFT and TWTR, I’ll get my GTC order placed and let the trades work themselves out. Every night, I take a quick look to see if things are moving as I would expect. If something doesn’t do what I’m hoping on a short term debit spread like these, I’m quick to cut my losses short and exit the next morning; usually an hour or so into the trading day. This lets the market settle down a touch and then I can manage an exit.

The rest of the week was full of good guys or trades that are working. I opened new credit spreads in TLT, EEM, GLD, IWM, SMH, XLV and FXI. Most of those appear to be working nicely for now. I’ll take them all off with around 50% profit; hopefully in the next couple of weeks. With volatility so low, it’s slim picking on these trades. I’ve been doing 16ish delta iron condors with the long wings at an appropriate risk level. I just can’t bring myself do straddles or iron fly’s with the premium so low right now.

For individual equities I’m playing BA, EXPE, GM, IBM, ROKU and TSLA this weekend into the earnings season. Most of these are roughly delta neutral positions except TSLA – that’s a flat out bearish play 🙂

I do have one long credit spread on in GDX right now; I opened it this morning and may take if off in the next 2 weeks if it doesn’t pan out.

This week was somewhere around 2.5% in total portfolio gains which wasn’t too shabby given that I’m currently short delta in all accounts while the market melts up.

The SPX selling strategy I’m testing this year was also nicely profitable this week. Funny enough, I didn’t sell the put sides of the strategy which cost me some premium this week because of my downside bias… and the only sides that ever had anything even approach was the call side. Follow the plan Ryan, follow the plan.

Stay safe in this market! It’s going to get crazy soon. I keep buying more VIX hedges, with another May spread this week. VIX volatility is starting to creep up, hopefully that means we get some real movements shortly.