I personally love it when the market gets a little crazy! It’s fun to trade things up and down and make some money in the process.

Tuesday morning I was able to load up on some new positions, a 20/10 “big lizard” on NFLX for a $12.36/contract credit with no upside risk (that was a nice earnings play) as well as a few longer term iron condors on IWM, IBM and XBI.

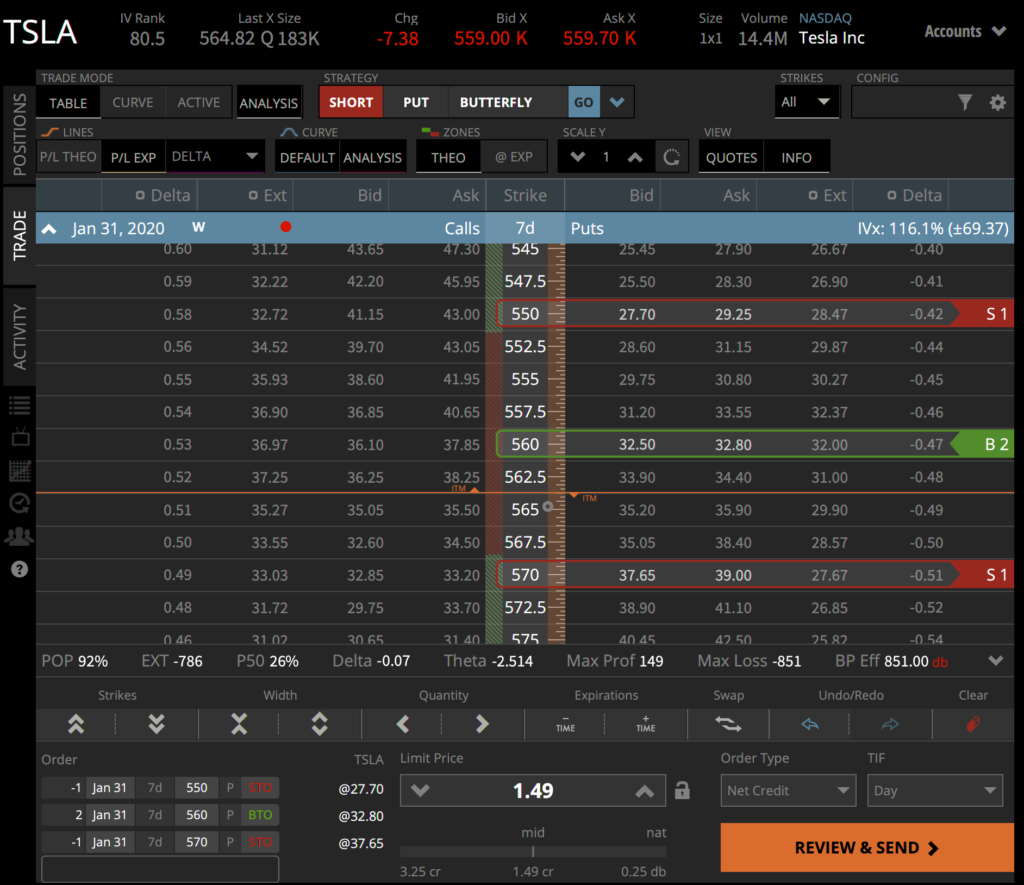

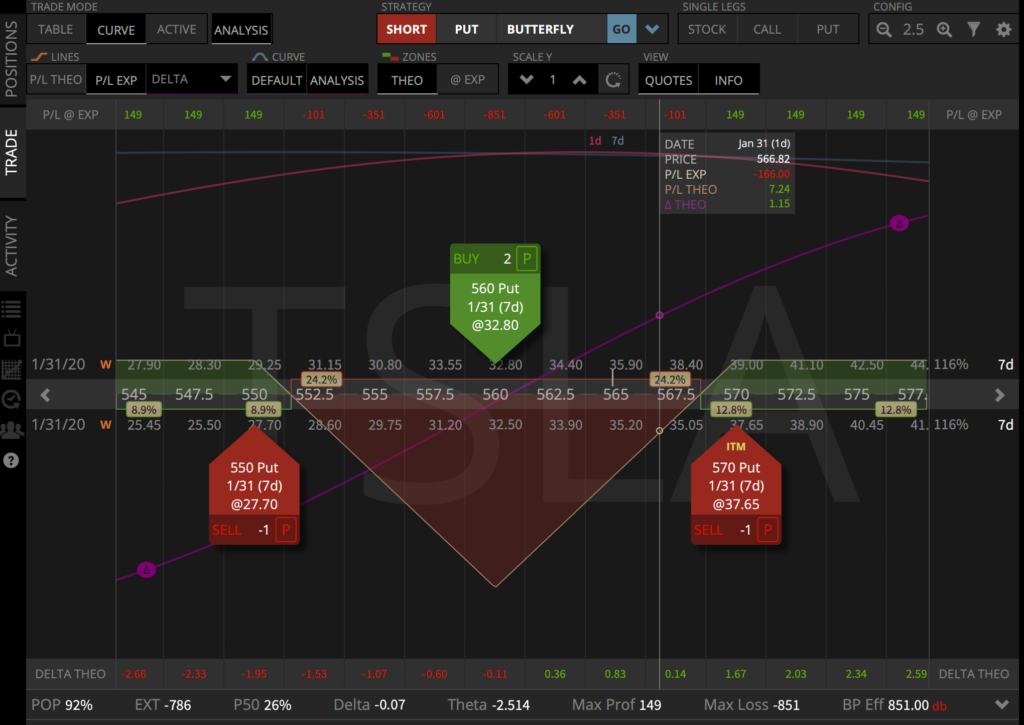

Given the market has been on a relentless tear north, I did open a few directional debit spreads on PLNT, WDAY and DE along with a few credit spreads on CRWD, X, INTC and TSLA. The PLNT and WDAY positions I closed this week for a loser and winner respectively.

Call me crazy, but I just cannot see how TSLA (above) doesn’t just come crashing back to earth. It’s way out in front of every expected move and is jittering around like crazy over the last week or two. This appears to be the classic short squeeze chart; however the “settled” (if a 10% range is settled to you…) pricing over the last three days does give me a bit of pause as it is starting to look a touch more orderly. I’m carrying a lot of negative delta on this guy and am planning to hold through earnings if it doesn’t drop before then. I’ve got a couple weeks after earnings for the positions to come back in if I’m wrong… and IV crush to help out (I hope).

Speaking of being totally wrong. I did try to get cute with INTC earnings and opened up a couple of positions – one of which I had to close for about 1/2 of max loss. I sold an IC outside of the expected move on this weeks’ weekly options (1 DTE when opened) and when INTC launched up after earnings, it was time to get out quickly before things got really ugly at expiration! I plan to ride out the remaining spreads that are in Feb and March cycles as the market moves around. I’ve got one with short strikes at 67.5 calls and 58 puts and another that is just a short the 75 calls. Hopefully the market will settle a bit at my 67.5 calls will be out of the money as we move into the month of Feb. The IV crush and slight market contraction early Friday morning was a huge help on the quickie condor – It was a 1 point wide 67/68 call 60/59 put IC for $0.29 with 1 DTE. I ended up getting out for a total of $0.69 per contract and left the long 59 put to expire worthless.

Given the little bit of market swoon we had on Friday, some open orders I had on filled and I was able to load up a few more positions in EEM, XLV, FXI and TSLA.

As the week closes, I’ve got about 19 tickers with open positions on which is not too bad of a mix. Next week I’m hoping we see some serious 2 sided action and I can start getting a few more things going – my watch list is long and ready to action on 🙂

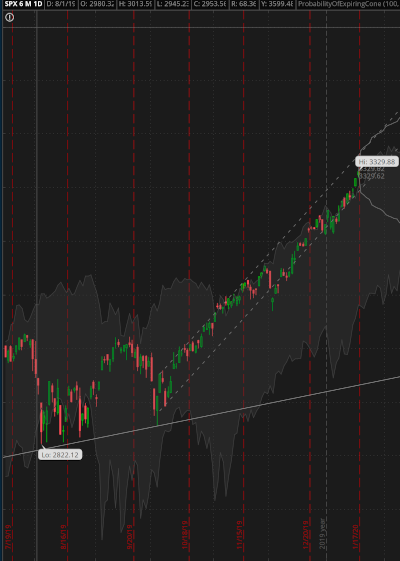

While I was cranky about it last week – persistence in holding futures contracts paid off nicely this week (yes, I held the short contracts all week long). I was able to get out for a reasonable profit on Friday and then got short again just after the market closed over the weekend. Right now, that position has a nice little profit and I’m expecting with the Coronavirus concerns that we should see more market weakness into next week.

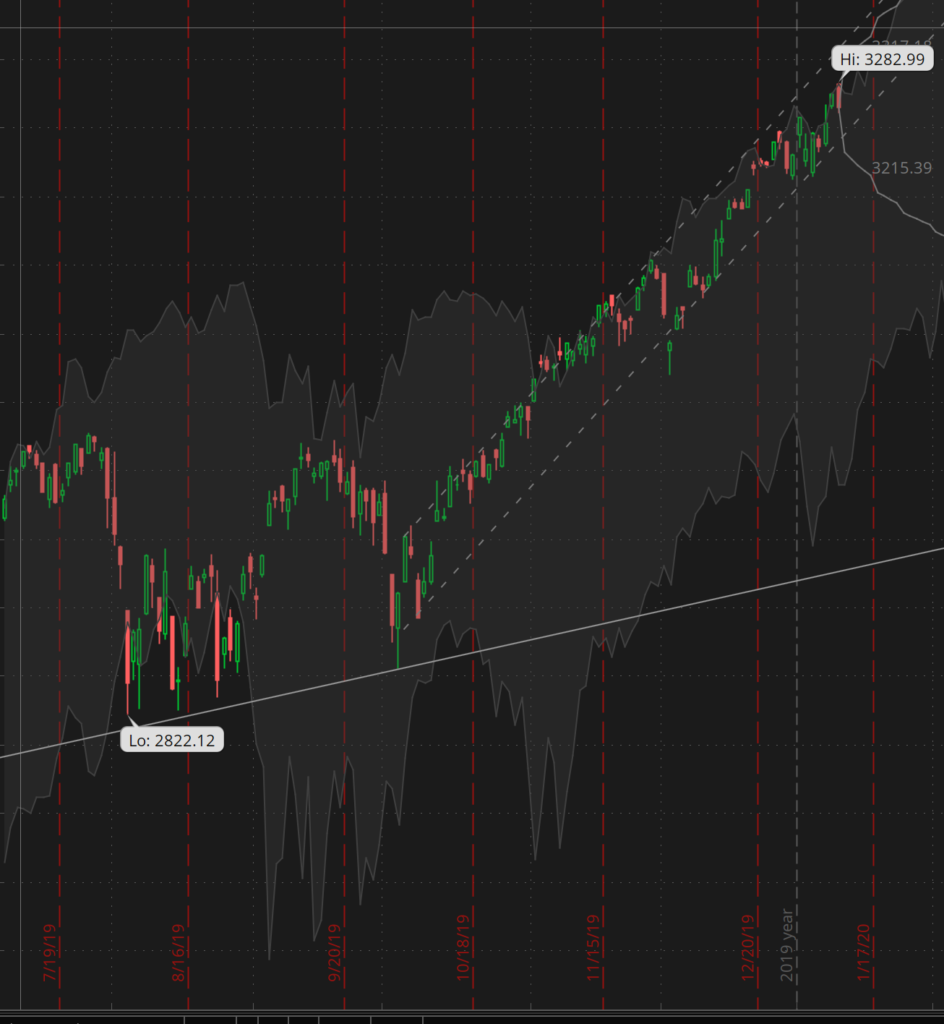

Looking at the chart of the SPX, it looks ready to just roll over. At a minimum I’d expect it to come back down to 3250, and quite frankly 3200 isn’t too far out of the question to close the gap from mid December. That’s only 3% away and with the virus concerns and maybe an earnings miss or two from the big players, it’s very possible. With AAPL on the 28th, TSLA the 29th and GOOG on the 3rd of Feb we have a couple of heavy hitters coming in soon. Not to mention V, MA, MCD, SBUX, AMD, FB, MSFT and AMZN… Yeah, it’s kind of a dense week :).

My little SPX experiment was also successful each day this week. I’m getting far more comfortable with how it’s working and plan to use the returns it is generating to scale up throughout the year. Right now I’m planning to scale with contract sizes; however I may widen out the spreads vs. more contracts and play the 2 different versions in different accounts to see the results.