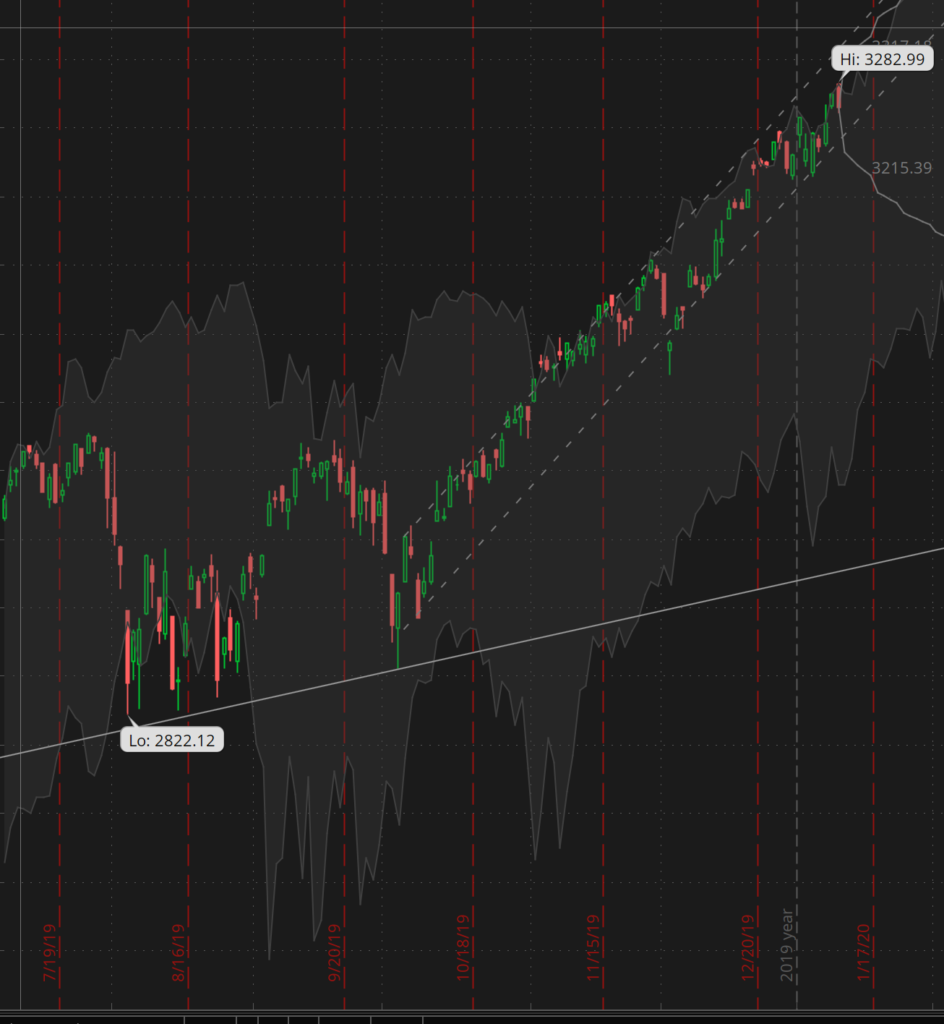

What a week this has been! The massive change of events and apparent de-escalation with Iran is great news! The market is continues to just chug ahead higher relentlessly. Friday’s action at least gave back a little bit, but wow – it’s been almost straight up for 3 months now in the SPX . They chart below is how I’ve been looking at it, mostly respecting this little channel and following the predicted vols pretty darn nicely.

This week I traded mostly SPX options and have been short the futures. My Monday SPX trade was a train wreck – due to user error. I posted the order for the wrong strikes and the market got away from me very quickly before I noticed the error; that one resulted in a unnecessary $1.02/contract loss. Even with that foolish mistake, I’m up about 60% in the past 45 days playing this strategy. I’ll keep using it for the rest of the year and see how it pans out; backtesting has been positive so it’s time to test future with real money.

I was hoping to get into some earnings calendars and maybe a few directional plays this week however the week got away from me. Being back in the office after the Christmas break brought a fairly busy week. The time I had hoped to trade in the mornings right after the open was scooped up with some work obligations.

This weekend I plan to see what may be out there that is interesting, and hopefully get into the of these positions starting next week. The market doesn’t seem much different (although higher) today than it did on Monday 🙂

I was looking at SNAP, MSFT, UBER, GM, AAPL, ROKU and BA as possible targets this week. Let’s see what the weekend hunting brings.