What a roller coaster of a week!

I started out with some spectacular gains in SPCE and a few other trades. After reflecting over the weekend, my posture changed to play the price action more aggressively this week and as a result moved to a very net long delta position across the board.

This included spreads in ROKU, CRWD, BA, MSFT, AAPL, SPY and others all with net long delta. Well, it turns out that again my market timing was pretty horrific as the market finally began to realize that the COVID-19 virus is real, and that economic activity is likely going to be curtailed a bit.

You’ll read everywhere that calling a top is hard – well, it is 🙂

I have a bunch of trades open for the weekend; a few of them don’t look that great. We’ll see how next week goes – I’m heavily hedged with short /ES again and a bunch of SPY and VIX short deltas. I think we are very near a top at this point, and if it isn’t this coming week, I think at a minimum it’s this year!

Current portfolio positioning is short delta and a bit shorter theta that I would prefer with all of my long puts 🙂

Here are the positions:

AAPL – Iron Condor in March 345/350 310/305

Apple looks like it’s forming a decent range around the 305/330 area. I’m starting to be a bit concerned as its recently broken the 200 hour moving average; however it’s longer term 50 day moving average sits right around 305.

Short term, the upward momentum for Apple has clearly faded away; it appears to either be forming an intermediate base or preparing to roll over. I’ll need to keep an eyeball on this guy. If it rolls over and breaches the upward trend, there is a LONG way to go before it find prior support.

The supply chain interruptions in China as well as potential reduced sales fo the iPhone due to COVID-19 could be a real problem for future earnings. It’s very possible this most recent leader, is the leader down.

ADBE – Put spread in March 365/360

ADBE was looking good until late this week. On Thursday, something occurred that caused a fairly large down move in the near term and it has now breached momentum. This continued into Friday which has me a bit concerned that I’ll need to close this out for a loss next week.

ADBE was in a very nice upward move and this spread started out pretty nicely last week. It’s a small position; and in continued market weakness I’m not sure if ADBE will be able to stay above my strikes.

CMG – Iron Condor in March 950/960 830/820

CMG has been on a tear lately! Selling an Iron Condor into this moving train was maybe not my best idea ever; however so far it’s been holding up. I am definately hoping for an extension of the recent pull back CMG has seen – ideally back to the 875-900 range. If CMG can pull into that range, I expect this guy can close down for a nice 50% profit.

COST – Call Spread Feb 325/320

Costco looks like it’s starting to top out here, so I’m playing this one on a short duration with the expectation of peeling off a 20-30% profit next week. Assuming the market continues to turn around and pull back a bit, Costco should do the same. I will continue however to spend lots of money in the warehouse as is our typical weekend pattern!

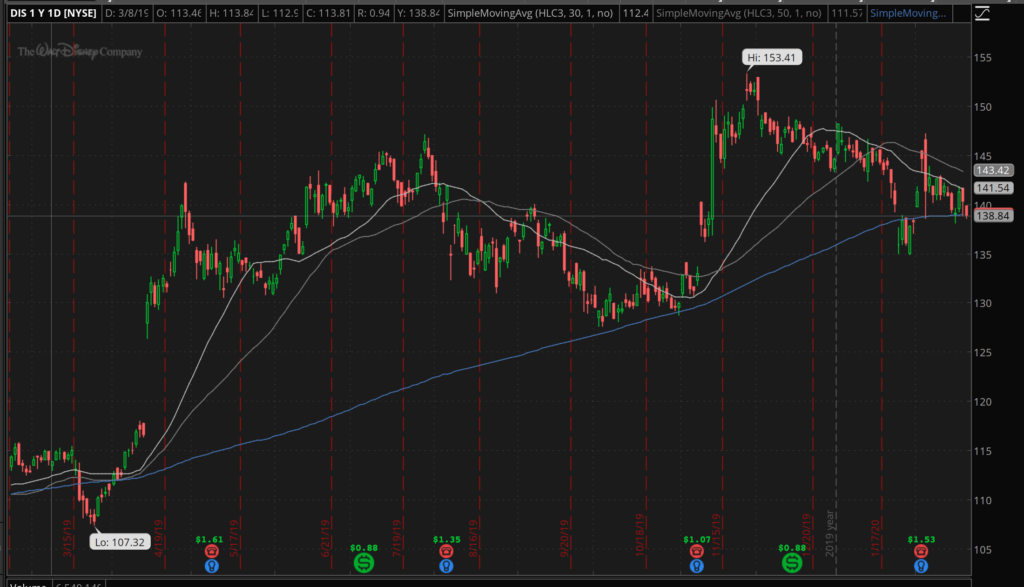

DIS – Iron Condor in March 145/150 135/130

This is a pretty standard trade. I’m going on the expectation that DIS is a little long on the whole Disney+ thing and that with all of that priced in it’s going to consolidate for a while. So far this trade seems to be panning out nicely. I opened it up last week, and have a 50% profit target currently.

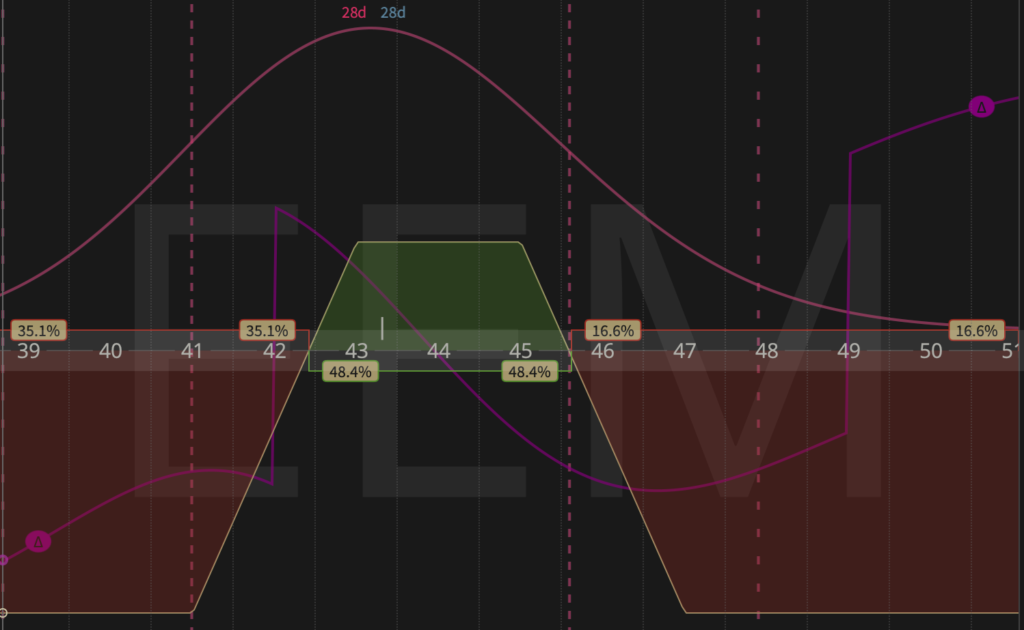

EEM – Various Feb and March; Main position is Iron Condor 45/47 43/41

I’m a bit wrapped around the axle on EEM right now with some straggler calls and puts from positions I’ve closed through the month of Feb. Given the moves EEM has had over the last 30 days or so, I’ve been able to take off a bunch of short options for near full profits.

The current position is getting close to being breached on the low side, but that’s likely okay if the typical pattern of this EEM plays out. It’s got a few weeks to work and I play to let theta decay do its thing.

FDX – Call Spread in March – 160/165

This one is currently breached as FedEx has run up quite a bit. I closed the put side of this Iron Condor for a nice fat credit during the week. The remaining position will likely be just fine as FedEx seems to like to go up to about 165 and then back to 140. I expect that’ll happen again here and this will close for a nice profit as well. Target is overall 50%.

GSK – Long 44 Calls in March

The Glaxo Smith Kline chart looks horribly oversold. The selling that occurred on the 5th was heavy volume, and it’s continued to follow through. I’m playing this on a fairly short leash under the simple assumption that it’s been under too much pressure. These where very cheap, and the position is fairly small. I’m looking to get out of these for a nice little profit next week.

INTC – Iron Condor in March 70/72.5 62.5/60

This one is right in the middle of the range or so. A little closer to the bottom that I’d like but that’s okay. Assuming the market does just take a total nose dive, I’ll try to get out of this guy for a 30% profit or so. It’s been open for a little over two weeks now.

MSFT – Put Spread in March 180/175

This one has been breached. I opened this guy up last week as a bullish move on Microsoft. Everything was looking good until the middle of this week when the wheels appear to have fallen off the Microsoft bus.

Originally, I was looking to get 50% on this guy. If MSFT has a move in my favor I’ll likely get out flat. Otherwise, we’ll wait and see what happens with MSFT. Continued downside pressure will force me to take a loss on this guy.

The 200 hour moving average is right around 175, so I’m hoping it’ll find support and bounce from there…

Because if it doesn’t, then it’s a long way back down to fill those gaps and come to previous support levels.

SHOP – Put Spread in Feb 500/490

If you can’t beat them, join them I guess. I had a nasty full loser on SHOP a week or so ago. This guy was a recent add to the portfolio. I’m targeting a 50% winner here assuming that SHOP can stay above 500 for the next week. it looks like it’ll just grind back to that area after that amazing earnings pop.

I’ve been in and out of SHOP since earnings and have cut about 2/5’s of that looser down. Hopefully this one can get another 1/5th or so back in my pocket. I’ve been riding it with call spreads back to the lower strikes; this time I’m playing for a base to be in place.

SPCE – Long Strangle in Feb – 42.5 and 25

I have no idea what SPCE is going to do. I just expect it’s going to move. The 42.5’s cost me $1.5 and the 25’s $1.1. I’m in the trade for $2.6 and don’t see any reason that it’s not going to be worth at least 2x that by the end of the week; hopefully more than that.

My reasoning is as follows:

- SPCE has earnings coming up which means that implied volatility is likely going to continue to get pumped into these options. They will go up in price.

- SPCE has earnings coming up which means that people are likely going to continue to FOMO freak out and drive this thing higher. There don’t appear to be any fundamental reasons for this – just MOMO.

- SPCE has earnings coming up – which means basically it’s going to just be crazy – see TSLA circa 2 weeks ago.

- SPCE is on every news feed that I’ve looked at. Everyone is trading it.

- All of the college kids are trading SPCE. I’m pretty sure that’s the same as the teller at COST telling me they made money on it….

Secretly (well not so secret now), I am hoping to close both sides of this for $5 each. It looks like in the near term it’s setting up for a nice squeeze breakout and appears to be about to roll over… Then again, it could just shoot back up to 45 before it comes down to 20, who knows?

SPX – Nothing now as they all expired worthless this week again. I’ll continue to scale these. Right now I’m up a little over 100% on this trade this year (return on risk).

I’ll keep these up per the plan. Testing looks good – I need to be patient and let this play out for a while.

SPY – Long Puts at 329, 330 and 332.

My heaviest long position is at 330. These are basically my portfolio hedge right now. I was in an out of /ES during the week with nice success. While I certainly didn’t earn back my persistent short futures losses from the past few weeks, I was able to scalp some nice gains on Thursday overnight and then as it rallied back.

TLT – Iron Condor in March 148/151 139/128

I’m worried about this one. The short calls have been breached and I think that bonds are going to continue to rip higher. This guy is already at about a 60% loser, so I may need to cut it loose or move up the puts. Given my market posture, I don’t see any reason for bonds to come back down anytime soon.

V – Put spread in March 205/200

This one hasn’t been breached yet, however Visa looked pretty ugly at the end of the week. It’s in an uptrend for now, but it’s a lot less convincing given the week-ending price action. Let’s see what next week brings. If I can cut this loose as a scratch position into market softness next week I’d be pleased. Otherwise, I’ll have to handle it a lot like Microsoft.

VIX – Calls, lots of calls in various months in the future. All well out of the money 🙂 Heavily hedged with VIX calls. Right now, they are up a bit. Let’s see what happens.

XLU – Call Spread in March 70/72

This one is breached as well. The utilities seem to have quite a bit of strength lately so we’ll have to see what happens here. XLU came down a bit on Friday so that’s encouraging. Theta decay is my friend as is what appears to be an overbought ETF.

XLV – Call Spread in March 105/109

XLV looks to be toping out and forming a bit of a double top. I am not sure of the COVID-19 outbreak is good or bad for healthcare stocks. Im assuming bad, and expect this guy will continue to roll over. We’ll see.