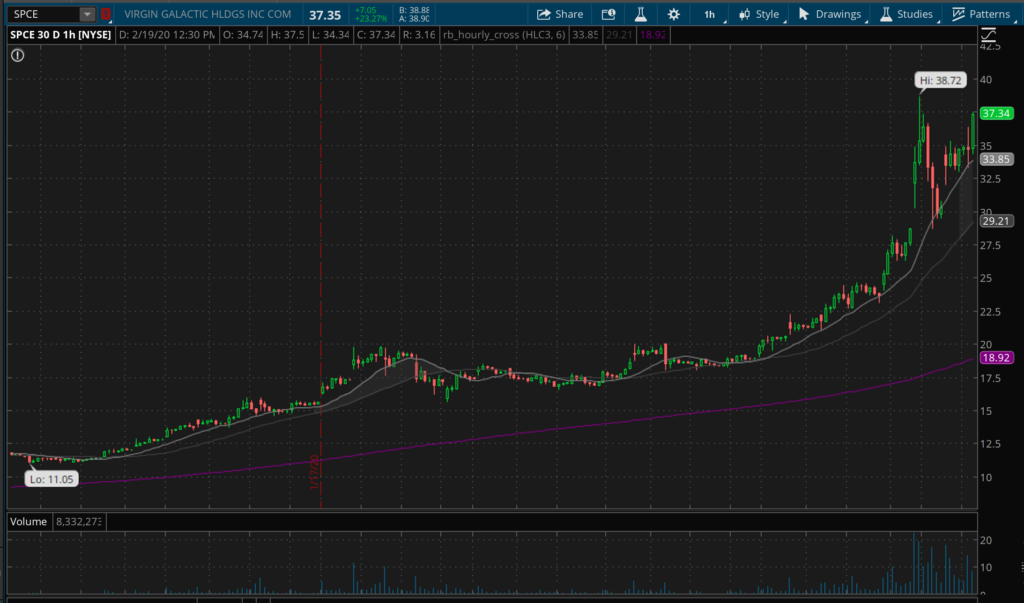

It’s getting toppy around here.

Who knows if this particular ticker continues to drive higher. Price action right now looks like it certainly will. It fell nicely to the upper moving average and road its way higher today. If this wasn’t a parabolic type of move…

Then the hourly price action looks really tradable. Yesterday closed with a red candle, but today was firmly green. It’s looking like maybe this thing continues to defy gravity for a while.

I’m considering another pre-earnings scalp, but just have a hard time pulling the trigger – there just ins’t any reason other than FOMO that this guy is rallying this hard.

With tic-tok videos on day trading options starting to show up. I’m growing more and more confident that a top is near – not just for SPCE but for the market in general. If it’s today or a year from now, I still have no idea.

Speaking of parabola’s how about TSLA and it’s crazy movement – again! The hourly chart looks like a nice long play is in the making but look at that daily just below!

All I can really say is wow; just wow. This is the classic castles in the sky scenario. Elon is smart, and he’s had some success, but this is well – seemingly unfounded and just crazy.

Pulling out my crystal ball – which in reality has zero predictive power – I’m going to say that TSLA is back to 800 inside a week and SPCE rips higher until earnings – after which it craters.

*Note, I’m not about to put money on those predictions yet 🙂

Be safe if you are trading these things. You can make a bunch of money if you go big – but it disappears just as easy as it shows up! If you are selling premium into the types of tickers, be extra careful. You can quickly find yourself in a wildly expanding vol market and price action moving in your favor, yet still lose money.

If I was going to play these, I’d be buying slightly longer dated options. They cost a bit more, but they still get the full impact of delta on price moves. You’ll be somewhat buffered from near term vol decrease/expansion and you’ll get less theta decay.

Just be careful!

Over the last couple of weeks, I’ve had more conversations with people about the market than in a long time. I’m sure some of that is my own excitement with the crazy things we are seeing – however a lot of it is people who are new to trading and are making big (for them) bets on things like TLSA and SPCE.

Again – just be careful! Options and leveraged products can bring tremendous rewards, but they come with much higher risk profiles if not managed correctly.