Futures opened nicely down on Sunday, so I got extra short as planned.

Look at that amazing little slice of the chart to the left. It’s pushing down and dropping like a rock! Exactly what I’ve been licking my chops to have happen as we all begin to recognize the “perfection” priced into the market and the real risks out there in the economy.

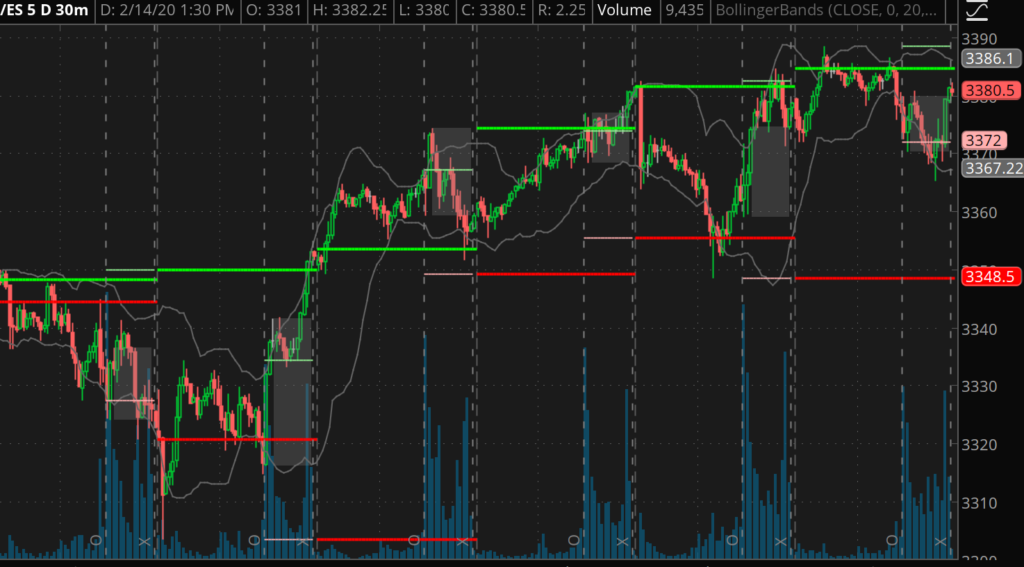

What I guess was unplanned was that by the time we closed on Monday there would be a more than 30 point swing in the /ES to the upside… Ouch, again. Just to pour salt on my woulds, we went to all time highs, multiple times (as they say on Tastytrade, it’s great for my 401k…). Below you will find the 30 min /ES for the week. I got extra short at the really low point on Sunday night.

It’s become abundantly clear to me that my ability to “time a top” is basically zero. So, I think it’s time to simply trade the price action and stay with what has been very successful for me over the years. Back to basics, back to the rules, back to appropriate position sizes (for the most part).

I was fairly busy with trades this week, but also extremely busy at work. I missed a few setups that I had planned to get into and was a bit disappointed about them. The biggest was ROKU. I was planning to drop an Iron Condor on for earnings and just missed it due to some work obligations. That would have been a sweet winner, to offset the awful loser I had in SHOP this week. SHOP turned into a max loss for me as it simply blew the doors off of earnings and I was on the wrong side of that trade! I think I held it for a week or two as it simply ripped higher; after that 50 point earnings gap there was’t much more management I could do to save that mess!

My portfolio is currently positioned to need a big move in the market. I still have a lot of SPY positions as I’ve been trying to chase a top for the past few weeks. If the market doesn’t come down a bunch in the next 7 days or so, I’ll have to realize some very sizable losses. I’ve put some longer term calls on to offset some of those should we continue to grind higher. Given that those are all debit positions, I’m losing theta every day so the worst thing that can happen to my SPY positions is for the market to just grind. I need some movement!

Throughout the week I really focused on cleaning up positions that where in the last parts of their lifecycle. Things with less than 14 days till expiration. A lot of those positions had nice moves that brought them back into profits and allowed me to close as winners. These included GLD, EEM, UNG and XLE.

I opened a slew of March positions in XOP, SPY, DIS, V, CMG, MSFT, TLT, GLD, EEM and XLE. These are either iron condors at approx the 30 delta short strikes, or credit spreads for things I have a directional bias on. I throw the long put and call on the condor to simply define the risk for allocation purposes. I’m sure it creates a drag on returns over time, but it’s saved my bacon enough times that I tend to avoid undefined risk straddles or strangles; preferring Iron Condors or Iron Butterflies.

For earnings this week, as I mentioned above I got nailed by SHOP however I had a nice winner with LYFT.

I was also in and out of a few TSLA and BYND positions throughout the week. None of those were sizable winners, however they all had small gains.

I did finally close out my BUD position for a pretty big loss. I’m not sure what happened to BUD over the last week or two, unfortunately that winner turned into a realized loser. I closed out SAFM, STNE, INTC and some others for a mixed back as well.

The last two weeks, it’s been clear that I’ve over traded a few tickers and it’s showing in my P&L. The positions sizes I’ve taken have been too big on a few key big mover names, and I remain over sized on SPY. If the market comes down hard next week, I’ll make a killing – however if it doesn’t I’m going to lose a mint. I had realized gains of more than 10% in January, and at this point I’m down to around 2% realized and I’m sitting on enough unrealized losses to pull my entire portfolio down to about -5% for the year. Position sizing matters, and I’ve gotten loose on it over the last couple of weeks. There isn’t much I can do to “fix it” right now in terms of existing positions, so I’ll be focusing on proper risk management to recover this little mess-up and get firmly back into the green over the next couple of weeks. I don’t expect it’ll take too long; however it’s a shame to give back money when you don’t need to.

For a long time, I’ve used a simple fixed dollar max risk method to limit losses in credit spreads, and I moved away from that on a few trades. I’ve also been buying far more options outright than I normally do. The combination of this two things has lead to some more rapid profit decay that I typically realize.

SPX selling was again totally profitable this week. This week I scaled with volume vs. spread width. I think I’ll stay in this mode for another month or two as I continue to build capital in test accounts. At my next scaling cycle, I’ll switch to scaling with spread width in the IRA account I’m trading this in, and continue with volume in the margin account I am also using. It’ll be interesting to see how those two different scaling modes work out over time.

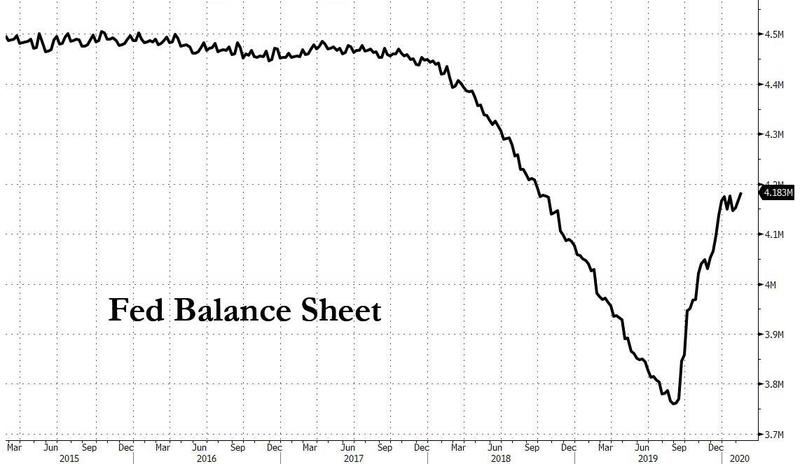

Oh yeah, my biggest loser for the year is now /ES; by far. I’ve simply been on the wrong side overnight as the fed pours money into the system and the market rips higher. I’m also apparently a sucker, as I put in an order to sell more at 3380 Friday into the close. Guess who got filled and is short again into the weekend… maybe I’ll learn, or maybe I’ll start eating into those losses as we all wake up to the fact that Covid-19 isn’t going away anytime soon and there will be a major drag on economic activity as a result. Then again, if the fed keeps this up I’m not sure it’ll matter too much.

Be safe out there trading! It’s hard to be a contrarian with so much liquidity being pumped in!