This post is a little late – it’s been a busy week and weekend!

Last week was just downright crazy in the markets. It seems like the week took a month or two to finish given how big the moves are and how crazy the trading has been.

On Tuesday the Fed cut rates by 50 bps; which was either a brilliant move or, more likely, a massive warning sign that things are going to get much worse before they get better. My guess is they do another 50 bps this month; I’m not sure they will wait until the meeting on the 18th, but that is where I would be placing odds.

Over the past 7 days, I’ve done a tremendous amount of position adjustment and changes to my risk profile again. The travel industry is continuing to get hammered (it doesn’t look like it’ll stop anytime soon) as major corporations start to cancel conferences and implement restrictions. The put spreads I had against these names were all too close to handle that kind of demand destruction, so I’ve mostly closed them down. Those companies are typically highly leveraged and operate on relatively thin margins when things are going well, so there will likely be continued selling pressure across those names. I will consider opening calls spreads with a shorter term bias on those names as time goes on.

This week, my focus was on a lot of COVID-19 short term plays; typically in the medical sector for those that are working on treatments, testing or the like. These names are showing tremendous volatility and opportunity for short term speculation.

I remain short vol via VXX and UVXY however those positions are starting to look less favorable as the weeks grind on. My UVXY positions are out in April so they have a decent chance of coming back in, however the VXX expire March 20th and are well under the current VIX readings. Given the likely timing of the spread of this virus (weeks and months vs. days), my expectation is that the VXX positions are going to be just too early for vol to come back in. Time will tell.

To manage against the tremendous amount of movement in SPY and the continued expansion of volatility, I’ve flipped to be more of a purchaser of SPY vs. a seller of it for now. I’ll evaluate this stance weekly for the next few weeks and eventually swing back the other way to sell premium. For right now, the moves are simply too large and vol expansion is simply too big to see these positions make money in the short term.

Typically I have longer term spreads on that are simply playing for theta decay and moves insight implied vol. I still have a bunch of April call spreads on across DIA, XRT, XHB etc… however, I haven’t done the put side of these and don’t plan on it to keep a bearish tilt in the portfolio from a selling perspective. I did round off my IWM and EEM positions to be neutral.

Quick portfolio review:

Long: AGRX, BCRX, NAK, VSTM, OPK

Neutral: EEM, IWM, CMG, WYNN, CCL, FDX

Short: DIS, DIA, XHB, UVXY, VXX, MGM, XRT

I’ve been using SPY as a scalping vehicle and currently have a slightly long delta position due to the current market movement – dynamic delta has been very dynamic recently. I’m long both puts and calls to scalp volatility spikes as well as have a normal neutral VERY WIDE iron condor for April that I’ve legged into.

Next week – I really have no idea where the market goes. Given the recent events in Italy and across the US; I expect that we’ll open the weekend with futures down and have more selling pressure. The market’s don’t look healthy with liquidity all but gone and I expect to continue to see massive moves in the major indexes for the next week(s).

My personal opinion here is once we get some degree of understanding of the true risk of COVID-19; the markets will adjust accordingly. For right now, it’s a massive cone of uncertainty with more downside risk than upside in my view.

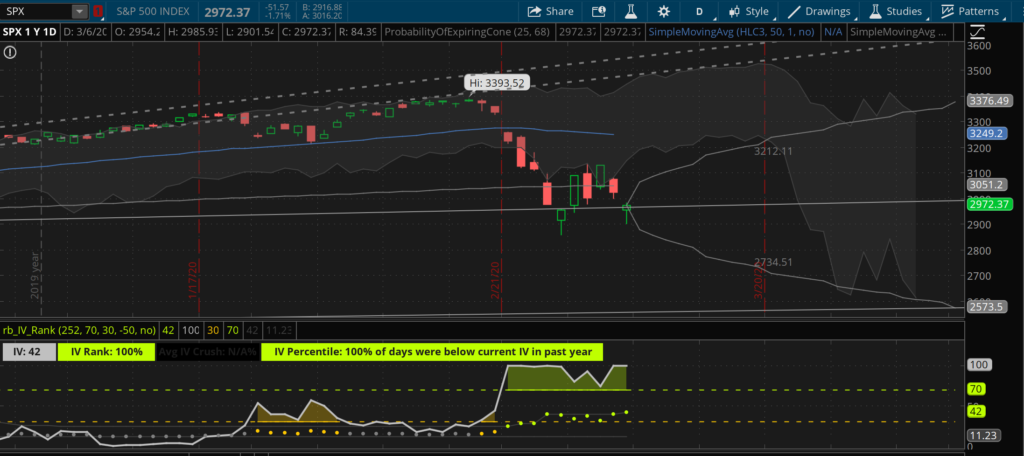

My SPX selling strategy had its first full loss this week. On Wednesday, my short call spreads where at 3125/3130. These where sold when the market was already up 40 or so points, and had about 90 points of head space above them.

As you can see from the charts below – SPX ramped just over my top strike into the close running about 20 points higher in 10 minutes or so.

Then immediately after the close, simply dropped back down 20 points so so.

There isn’t much one can do with a situation like that. However, it is interesting to see how the backtesting played out perfectly on this one. My testing had shown that the biggest risk to these positions is on massive up moves.

The good news is that even with the loser on this trade, I’m still up on a unit basis for the year. Overall down due to scaling, but that’s okay. I’ll keep testing and if this strategy can survive a market like this – well good grief it should be able to survive anything!