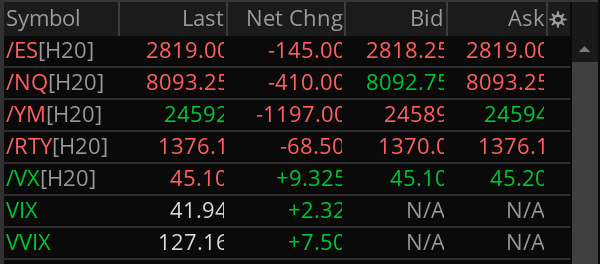

Monday looks like it’s going to be quite the ride. As I type this late Sunday evening, the /ES dropped like a rock and is basically pinned to limit down; treasuries have fallen to sub .5% on the 10 year, the 30 year is below 1% and oil has cracked $30…

Absent some sort of intervention, we are experiencing a real crisis and may see a true crash tomorrow and into this week.

Circuit breakers:

Assuming the Fed doesn’t jump in tonight, I wouldn’t be shocked to see a Level 1 halt, possibly even a level 2 halt tomorrow. For those of you that aren’t aware of these basically they work as follows:

Level 1 – At a 7% down move, trading stops for 15 minutes (if it happens before 3:25 PM EST)

Level 2 – At a 13% down move, trading stops for another 15 minutes (if it happens before 3:25)

Level 3 – At a 20% down move, trading is halted for the rest of the day.

If you want more info: CME Group has futures info here, CNBC did a piece a few years back here and of course the SEC has the final word here.

Given the recent intraday price movements we’ve seen, and that /ES futures are locked limit down at 5% on the Globex session, another 2% at the open seems very possible.

The speed and size of these moves over the past week have likely resulted in liquidations and a few firms “blowing up” as they cannot cover margin requirements due to vol expansion, gamma risk and all of the related problems that come with these massive moves. With /CL, /ZN, /VX and /ES doing what they are doing tonight – more liquidations tomorrow seems very possible – and that means more downside pressure.

Be safe and manage your risk sizing!!! As I write this:

It’s not looking good for tomorrow’s opening, or likely the next couple of weeks…