Unless you’ve been hiding under a rock for last the last few weeks, you’ve heard all about the panic that is the Coronavirus a.k.a. COVID-19. It’s possibly a really scary economic reality that will hit the global system over the next few quarters, and you should begin to prepare yourself and your family. I’m not a doctor, or virus expert – so I’ll leave those things to the professionals; I am however quite proficient at budgeting and believe firmly that having a strong budget in times of crisis is critical.

Budgeting is actually really simple to do. It’s scary for those that haven’t done it before, and can feel stifling if you don’t wrap your mind around the reality that having control and oversight of your finances gives you a ton of freedom!

At its core, a budget is a simple plan that is created to direct spending and provide visibility to areas of spending. Budgets are one of the most effective and simplest ways to manage your money, build wealth and create freedom.

You don’t need to make six figures or have millions in the bank to have a budget. In fact, if you find yourself living paycheck to paycheck – it’s critical that you get a budget in place immediately. Without a budget, your ability to get away from living paycheck to paycheck and moving toward financial independence is critically hampered.

You can make a budget on a napkin, in a journal, using a spreadsheet or with any number of fancy pieces of software. I’ve made no secret of my support for You Need a Budget, and would strongly suggest you check it out if you’re interested in the software route.

If you are ready to start…

The first thing you need to do is get an understanding of what you actually have.

I’m a fan of budgeting cash in your possession, not what you think may show up in the future. I’ve been burned enough times in my life with poor forecasting to realize that cash in hand budgets are way more effective than ones that anticipate a reality that may not materialize.

Please note, I’m not suggesting here that you avoid longer term financial planning and the like; I just view that type of work as very different that your daily operational personal budget.

To get started here, it’s pretty simple. Open up your wallet, your bank register(s) and your savings account(s) – add up the money and write it down.

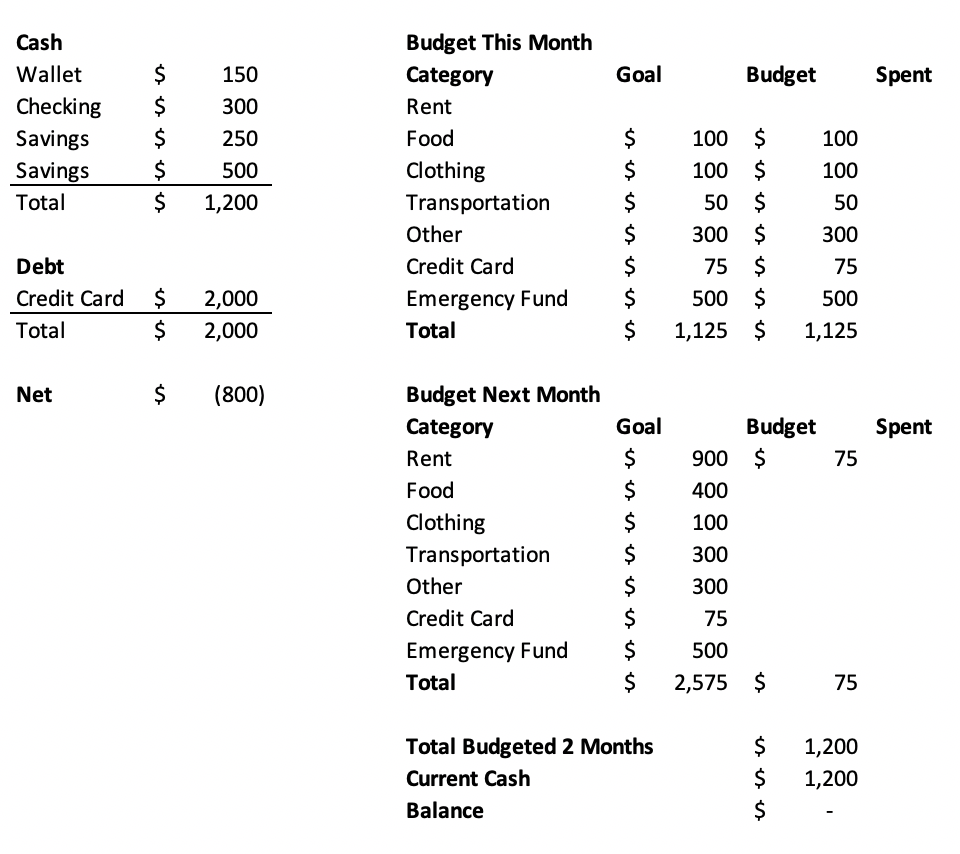

Let’s pretend that you have the following situation:

- Wallet: $150

- Online Checking: $300

- Online Savings: $250

- Other Savings: $500

If you add all of those accounts up, you’ll find that you have $1,200 in cash. That’s a great thing to know and to have as you look at the next piece.

Once you understand what you have, you need to understand what you expect you’ll need and start to allocate what you have. I’ve found the simplest way to do this is to look through your bank and or credit card statements to see what you spend. If you spend a lot of cash, it’ll be tougher to be exact and you’ll have to guess a bit.

You can think of your historical spending as a “goal” of funding for each month. You may want to try and lower the spending, or increase it – regardless having a target is crazy important!

For sake of this example, let’s assume the following:

- Rent: $900/mo (already paid this month)

- Food: $400/mo (already spent $300 this month)

- Clothing: $100/mo

- Transportation: $300/mo (already spent $250)

- Other expenses: $300/mo

- Credit card payment: $75/mo (Balance: $2,000 – vacation was great…)

Given that you’ve already paid a bunch of your expected monthly expenses, your first task is now to allocate that $1,200 of cash and give it a job! Personally, I like to have jobs that are not just to cover my expenses, but also for important things like emergency funds etc…

Okay – so let’s get the first “budget” up and running for the remainder of the month:

- Emergency Fund: $500

- Food: $100

- Clothing: $100

- Transportation: $50

- Other expenses: $300

- Credit card payment: $75

At this point, you’ve budgeted $1,125 of the $1,200 in cash that you have! That remaining $75 should get a job right away, and if this was my personal situation, I’d put it immediately toward next months rent chipping away at the upcoming payment of $900.

- Next month Rent: $75

Boom – now you’ve budgeted all of the cash that you have and can start to get a feel for what you need in the next month. You know right away that you need another $825 to pay the rent, and then can start to fill up other categories right away as you get your next paycheck.

Here is a quick snapshot of what this might look like in a spreadsheet:

You can get way more complicated for sure but this is a simple way to start! You can start to track your spending in your spreadsheet and do a little math to see what is left as the month goes on.

Eventually, this gets pretty complicated in Excel – so again I’ll plug YNAB 🙂

Putting it in practice

With your newly minted budget – it’s time to use it! If your buddies give you a call and suggest a road trip for the weekend, including hotel and an expensive micro-brew round up…. you get to make an informed choice.

You can quickly look to your budget and ask: Do I have enough cash today to enjoy this trip? If you have the cash, and it’s in the right categories – then have a great weekend! If you find that you have the cash, but you’ll need to raid another category, you know can make an educated decision on what is more important to you – and you can start to get control of your spending very quickly.

Why does it matter?

For me personally, I’ve found that without a plan – money tends to disappear. It gets spent on frivolous things, and that can create situations where important things get put at risk.

Given some of the uncertainty facing our economy for the next few quarters, now is a great time to get a bit of control and start to make informed choices in how you spend you money!